Navigation

Token

Inflation is the general increase in the price level of an economic area over a certain period of time. In Switzerland, the national consumer price index (CPI) is used to measure this. If this index rises, you can buy fewer goods or services with each monetary unit (e.g. CHF 100). Consequently, the purchasing power of money decreases with inflation. This is therefore referred to as currency devaluation.

This basically affects everyone, but savers who leave their money in the bank are affected the most. Use our inflation calculator and be amazed at how much you would lose through inflation. You can find out how you can protect your assets below.

Use our inflation calculator to work out how much you yourself will be affected by inflation and how much the money in your account will lose purchasing power over time.

The are:swiss share is available as a digital token, which makes you independent of banks.

Invest in real estate and build up your digital real estate portfolio in just a few minutes.

Currency stability and inflation

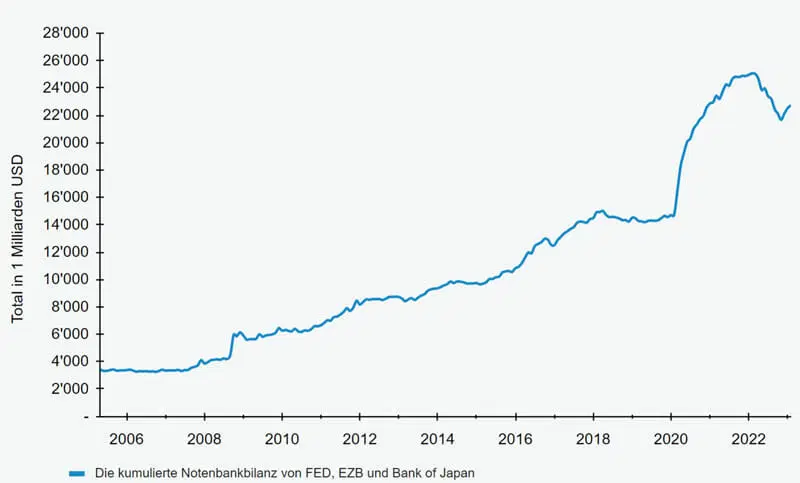

The equivalent value of a currency remains stable if the money supply and economic growth grow in tandem. However, if the money supply increases faster, this will sooner or later lead to inflation.

Since 2020, central banks around the world have drastically expanded the money supply to cushion the economic impact of the Covid-19 pandemic and, more recently, geopolitical tensions. This has increased the value of the US dollar alone by around 25%. With each additional unit of currency, the value of each individual unit decreases - a creeping dilution of purchasing power occurs. In addition, persistent supply bottlenecks, high energy costs and shortages of raw materials are weighing on many economies. These developments have led to global inflation, which is still affecting households and companies today and slowing down economic growth.

The usual measure is the annual percentage change in the price index. The national consumer price index measures inflation based on the price development of a basket of goods, which includes the most important consumer goods, rent, petrol and other goods for the daily needs of private households.

The weighting of the basket of goods is updated annually. The basket of goods does not include prices for asset classes such as real estate, precious metals or shares. If these so-called asset prices were included in the calculation, we would have had a much higher inflation rate in recent years.

In an economic environment with inflation, saving in a bank account that does not generate interest is not worthwhile. On the contrary: due to rising prices for everyday goods, your savings are constantly losing purchasing power. Pension assets that are only held in one account are also affected. In the following short video, we explain why maintaining purchasing power is very important for your assets.

First think about how much money you will actually need in your account in the coming years in order to realize your plans. Also take into account unforeseen expenses, such as the purchase of a new kitchen appliance or other unexpected costs. A good rule of thumb is to have about... three months' worth of household income available in your account at all times. You should let the rest of the money work for you and invest it.

Seek advice from your bank and have an individual risk profile drawn up. Define your most important goals, such as capital preservation and inflation protection, and discuss your return expectations. Basic rule no. 1 for investments: the higher the expected return, the higher the risk. This also means that the more security you strive for, the less your investments should fluctuate. Review and update your investor profile at least every two years to adapt it to your current life situation.

Many banks will recommend their own portfolio funds or asset management mandates. The advantage of these products is the broad diversification of your investment across different asset classes. However, a significant disadvantage for conservative investors is the high proportion of bonds, which often make up 45-70% of the portfolio. These supposedly safe bonds lose value every time interest rates rise. In an inflationary environment, most investment experts therefore advise against buying bonds, as it is extremely difficult to achieve a positive net return with debtors with good credit ratings.

The focus is on scarce real or tangible assets, as they can keep pace with price trends.

Are you interested in investing in the are:swiss token? Here you will find answers to the most frequently asked questions, information about the purchase and our contact details. We are here for you.